Sharpe Ratio Calculator In Excel

Divide this value by the standard deviation of the portfolio returns which can be found using the STDEV formula. This can be daily or weekly returns too but monthly would likely be suitable for a generic long term investment.

Implied Volatility Of Options Volatility Analysis In Python Harbourfront Technologies In 2021 Implied Volatility Analysis Option Strategies

Sharpe Ratio P 1887 - 172 2071 083.

Sharpe ratio calculator in excel. Steps to Calculate Sharpe Ratio in Excel. And a higher Sharpe ratio can be achieved by high returns and low volatility. Sharpe Ratio R p R f p 252.

Then in the next column insert the risk-free return for each month or year. The otherwise intimidating Sharpe ratio formula can be made easy using Microsoft Excel. CAPM portfolio return risk sharpe.

Email me at HELPPLUSACADEMICSORGThis video give step by step method of how to calculate sharpe ratio using excel. Sharpe ratio solves this problem by factoring in risk volatility along with the return. Collect monthly or daily returns data.

You can get this data from your investment provider and can either be month-on-month or year-on-year. The average daily return of the portfolio is 0026 while the rate of risk-free return is 0017. Black Scholes Model Options Calculator Excel Sheet.

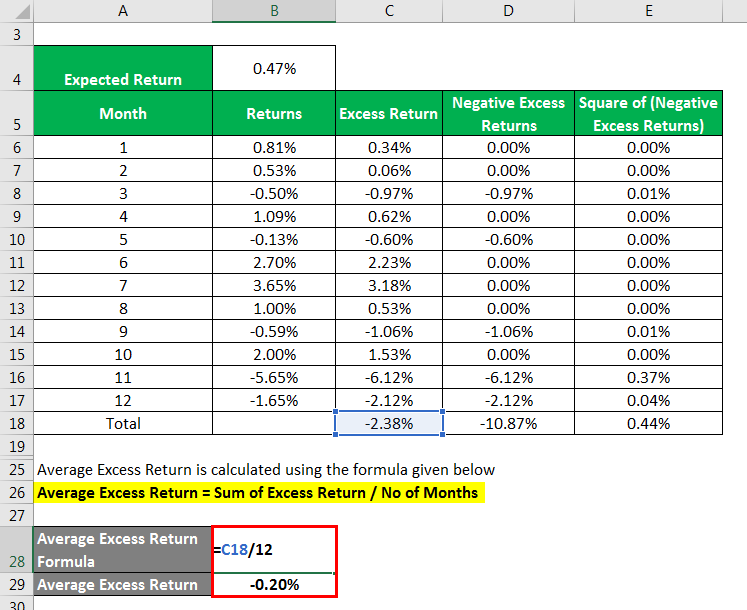

The Sharpe ratio is commonly used as a means of calculating the performance of an investment after adjusting for its. In another open cell use the STDEV function to find the standard deviation of excess return. To calculate the Sharpe Ratio find the average of the Portfolio Returns column using the AVERAGE formula and subtract the risk-free rate out of it.

Finally the Sharpe ratio can be annualized by multiplying the above ratio by the square root of 252 as shown below. Next calculate the average of the excess return values in a separate cell. Finally calculate the Sharpe ratio by dividing the average by the standard deviation.

Devised by American economist William Sharpe of Stanford University in the 1960s and revised by him in 1994 the ratio has become one of the most widely used metrics in. Get the monthly portfolio balances from which you can calculate monthly returns as shown in the figure below. Sharpe ratio .

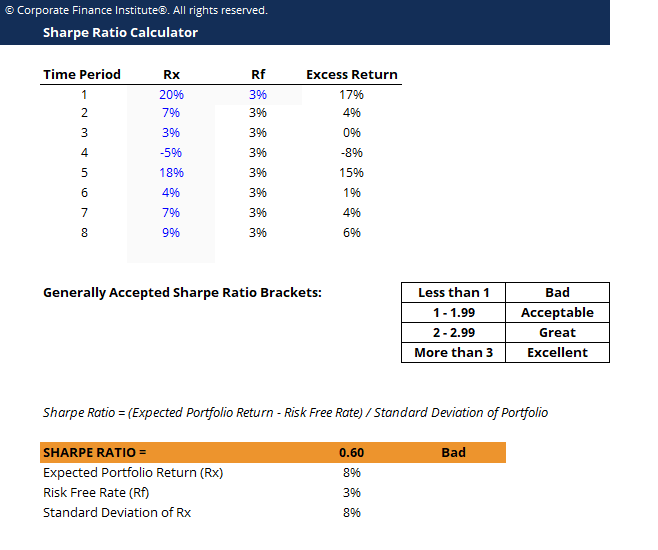

Reading the Results. Reviews Add a review. This sharpe ratio calculator template demonstrates the calculation of sharpe ratio to determine an investments performance relative to risk.

To calculate the Sharpe Ratio find the average of the Portfolio Returns column using the AVERAGE formula and subtract the risk-free rate out of it. Lets take an example to understand the calculation of Sharpe Ratio formula in a better manner. The higher the Sharpe ratio the better is the system.

First insert your mutual fund returns in a column. Let us take the example of an investment portfolio to illustrate the calculation of the annualized Sharpe ratio based on return information. S x rx Rf StandDev rx .

Sharpe ratio Mean portfolio return Risk-free rateStandard deviation of portfolio return or S x rx - Rf StandDev x To recreate the formula in Excel create a time period column. Please comment below if you have any questions. Reading the Results.

This Sharpe Ratio Calculator will guide you through the calculation of the ratio of returns for a portfolio relative to its risk. Sharpe Ratio Calculator Excel Sheet Trading Tuitions - Free download as Excel Spreadsheet xls xlsx PDF File pdf Text File txt or read online for free. Alternatively depending on the version of Excel.

Home Financial Model Templates Sharpe Ratio Excel Calculator. Divide this value by the standard deviation of the portfolio returns which can be found using the STDEV formula. A higher ratio is considered better.

Sharpe ratio Mean portfolio return Risk-free rateStandard deviation of portfolio return or Sx rx Rf StandDevrx. A higher ratio is considered better. How to Recreate the Formula in Excel.

Examples of Sharpe Ratio Formula. Calculate the portfolios Sharpe ratio if the standard deviation of the portfolios daily. Sell a Template My Cart Register Login.

Finally calculate the Sharpe ratio by dividing the average by the standard deviation. Next calculate the average of the excess return values in a separate cell. Read more about financial modeling careers.

The Sharpe ratio helps an investor evaluate the relationship between risk and return for a stock or any other asset. Here is the standard Sharpe ratio equation. Besides that it shows.

Steps to Calculate of Sharpe Ratio in an excel spreadsheet ex post Step 1. In another open cell use the STDEV function to find the standard deviation of excess return. Sharpe Ratio R p R f p.

So I am sure now you are clear as to how to calculate Sharpe Ratio formula in Excel.

Calculate The Sharpe Ratio With Excel

Measures Of Central Tendency Riddle Time Central Tendency Riddles Central

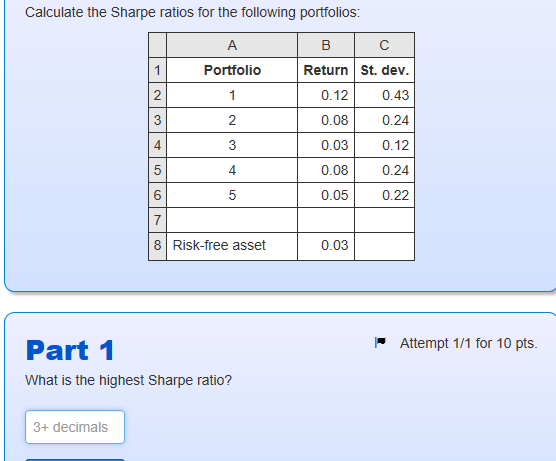

Calculate The Sharpe Ratios For The Following Chegg Com

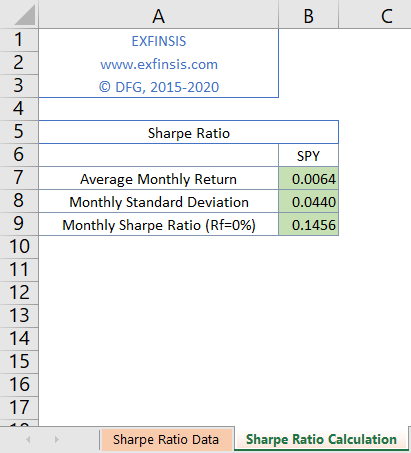

Sharpe Ratio Performance Metric With Excel Exfinsis

Sharpe Ratio Excel Top Guide To Calculate Formula In 2021

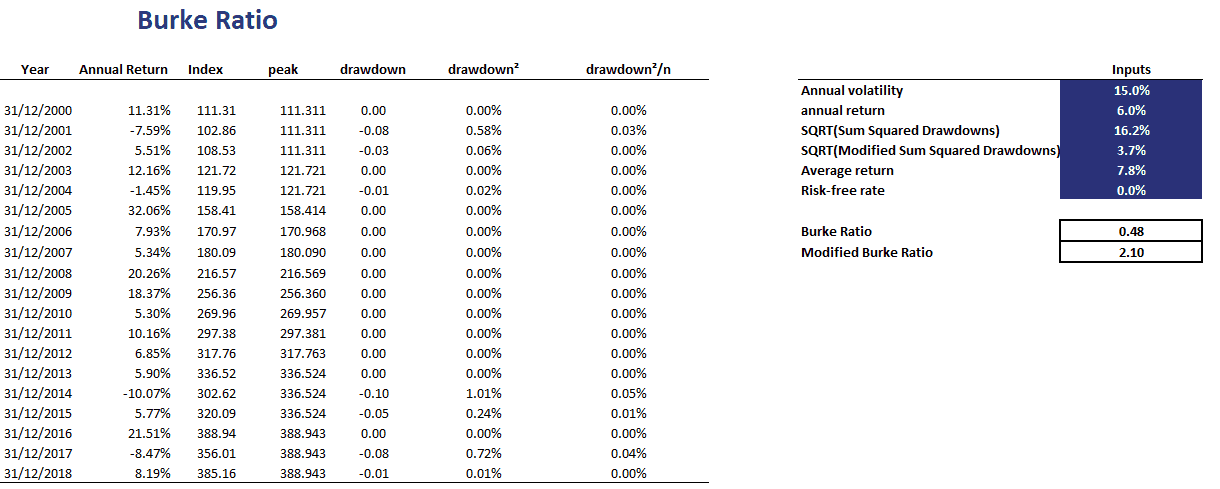

Burke Ratio Implementation In Excel

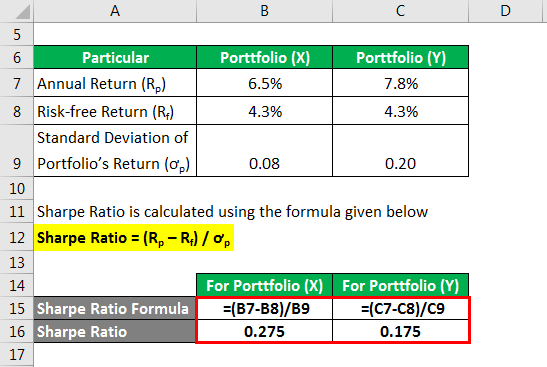

Sharpe Ratio Explanation Example With Excel Template

This Article Describes How You Can Implement The Sharpe Ratio In Excel Business And Economics Excel Economics

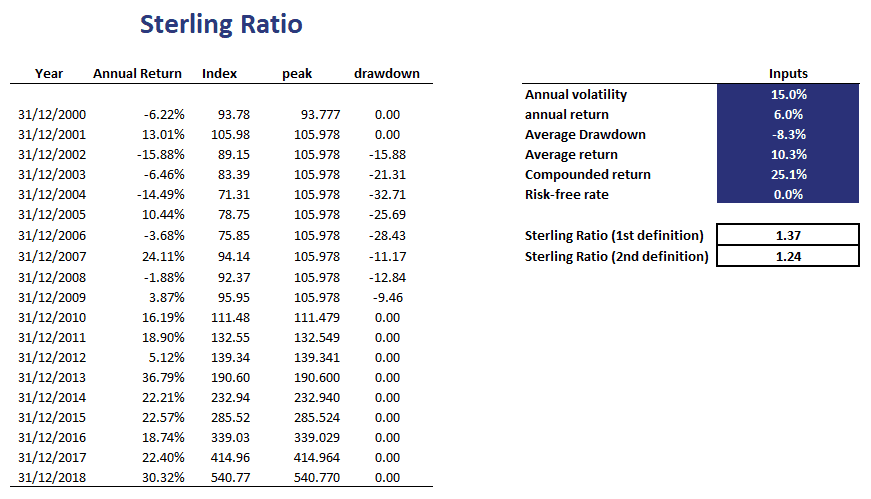

Sterling Ratio Implementation In Excel

Sortino Ratio Explanation Calculator Example With Excel Template

Information Ratio Formula How To Calculate Information Ratio

Value Averaging Vs Dollar Cost Averaging

Calculate The Sharpe Ratio With Excel

Sharpe Ratio Calculator Excel Sheet Free Download Detailed Tutorial

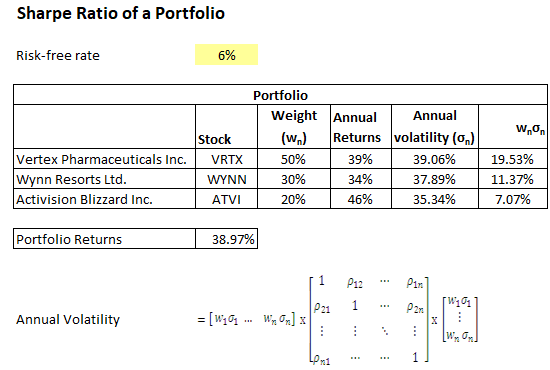

Sharpe Ratio Of Portfolio With Marketxls Formulas

Automated Trading Software In India Top Recommendations Automated Trading Automated Trading Systems Automation

Posting Komentar untuk "Sharpe Ratio Calculator In Excel"